The Only Guide for Banking

Wiki Article

Everything about Bank Reconciliation

Table of ContentsThe smart Trick of Bank Account Number That Nobody is Talking AboutBank Statement Things To Know Before You BuyBank Account Number Fundamentals ExplainedExcitement About Bank Reconciliation

You can also save your cash and also make passion on your financial investment. The cash kept in many savings account is federally guaranteed by the Federal Deposit Insurance Policy Company (FDIC), as much as a limit of $250,000 for private depositors and $500,000 for collectively held deposits. Banks additionally provide debt chances for people and also firms.

Banks make a profit by billing even more passion to borrowers than they pay on cost savings accounts. A bank's size is identified by where it is situated and that it servesfrom small, community-based establishments to large industrial banks. According to the FDIC, there were just over 4,200 FDIC-insured business financial institutions in the United States since 2021.

Conventional financial institutions provide both a brick-and-mortar location and an online presence, a new fad in online-only financial institutions emerged in the very early 2010s. These banks usually provide consumers higher rate of interest and also reduced fees. Benefit, rates of interest, and also fees are several of the factors that help consumers choose their liked banks.

The Main Principles Of Bank

financial institutions came under extreme examination after the international economic crisis of 2008. The governing setting for banks has actually given that tightened considerably as an outcome. United state financial institutions are regulated at a state or national degree. Depending on the structure, they might be regulated at both levels. State financial institutions are controlled by a state's department of financial or division of banks.

You should consider whether you wish to keep both company and personal accounts at the very same bank, or whether you desire them at separate banks. A retail financial institution, which has basic banking solutions for customers, is one of the most proper for daily banking. You can choose a standard financial institution, which has a physical building, or an on the internet financial institution if you don't want or require to physically visit a financial institution branch.

, for instance, takes down payments and also lends in your area, which can offer a more tailored financial relationship. Select a convenient area if you are choosing a bank with a brick-and-mortar place.

The Basic Principles Of Bank

Some banks likewise provide mobile phone apps, which can be helpful. Examine the charges associated with the accounts you want to open up. Financial institutions bill interest on car loans as well as month-to-month maintenance fees, overdraft account costs, as well as wire transfer charges. Some large banks are relocating to end over-limit fees browse around these guys in 2022, to make sure that could be a vital consideration.Money & Development, March 2012, Vol (bank account). 49, No. 1 Establishments that pair up savers and consumers help make certain that economies function efficiently YOU have actually obtained $1,000 you don't need for, state, a year as well as desire to earn earnings from the money till then. Or you intend to acquire a home as well as need to obtain $100,000 as well as pay it back over thirty years.

That's where financial institutions can be found in. Banks do several things, their primary role is to take in fundscalled depositsfrom those with money, swimming pool them, as well as offer them to those who need funds. Banks are intermediaries in between depositors (that offer cash to the financial institution) as well as customers (to whom the bank offers money).

Depositors can be individuals as well as families, monetary as well as nonfinancial firms, or national and city governments. Debtors are, well, the same. Deposits can be available on demand (a bank account, as an example) or with some restrictions (such as cost savings as well as time deposits). While at any provided moment some depositors require their money, most do not.

The Ultimate Guide To Bank

The process includes maturation transformationconverting temporary responsibilities (deposits) to long-term possessions (fundings). Banks pay depositors why not check here less than they obtain from borrowers, as well as that difference represent the bulk of financial institutions' revenue in most countries. Financial institutions can complement conventional deposits as a source of funding by straight obtaining in the money and also resources markets.

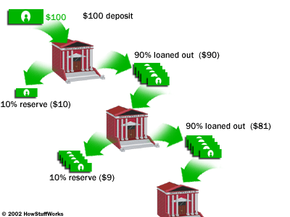

Banks maintain those called for books on deposit with main financial institutions, such as the United State Federal Get, the Bank of Japan, as well as the European Central Financial Institution. Financial institutions create cash when they offer the remainder of the cash depositors give them. This money can be utilized to purchase goods as well as solutions as well as can find its back right into the banking system as a down payment in an additional financial institution, which then can lend a portion of it.

The size of the multiplierthe amount of cash developed from a preliminary depositdepends on the amount of money banks should keep book (bank reconciliation). Banks also offer and reuse excess cash within the monetary system and create, distribute, as well as trade safeties. Banks have numerous methods of earning money besides pocketing the distinction (or spread) between the rate of interest they pay on down payments and also borrowed cash as well as the rate of interest they collect from debtors or safeties they hold.

Report this wiki page